Sollatek Kenya Issue 14: 6% Bond

£40,000 | 76 | 0 |

4 million people

4 million people

The total number of Sollatek systems deployed has impacted the lives of approximately 4 million people.

835,000 units

835,000 units

Sollatek has sold over 835,000 solar lanterns and solar home systems

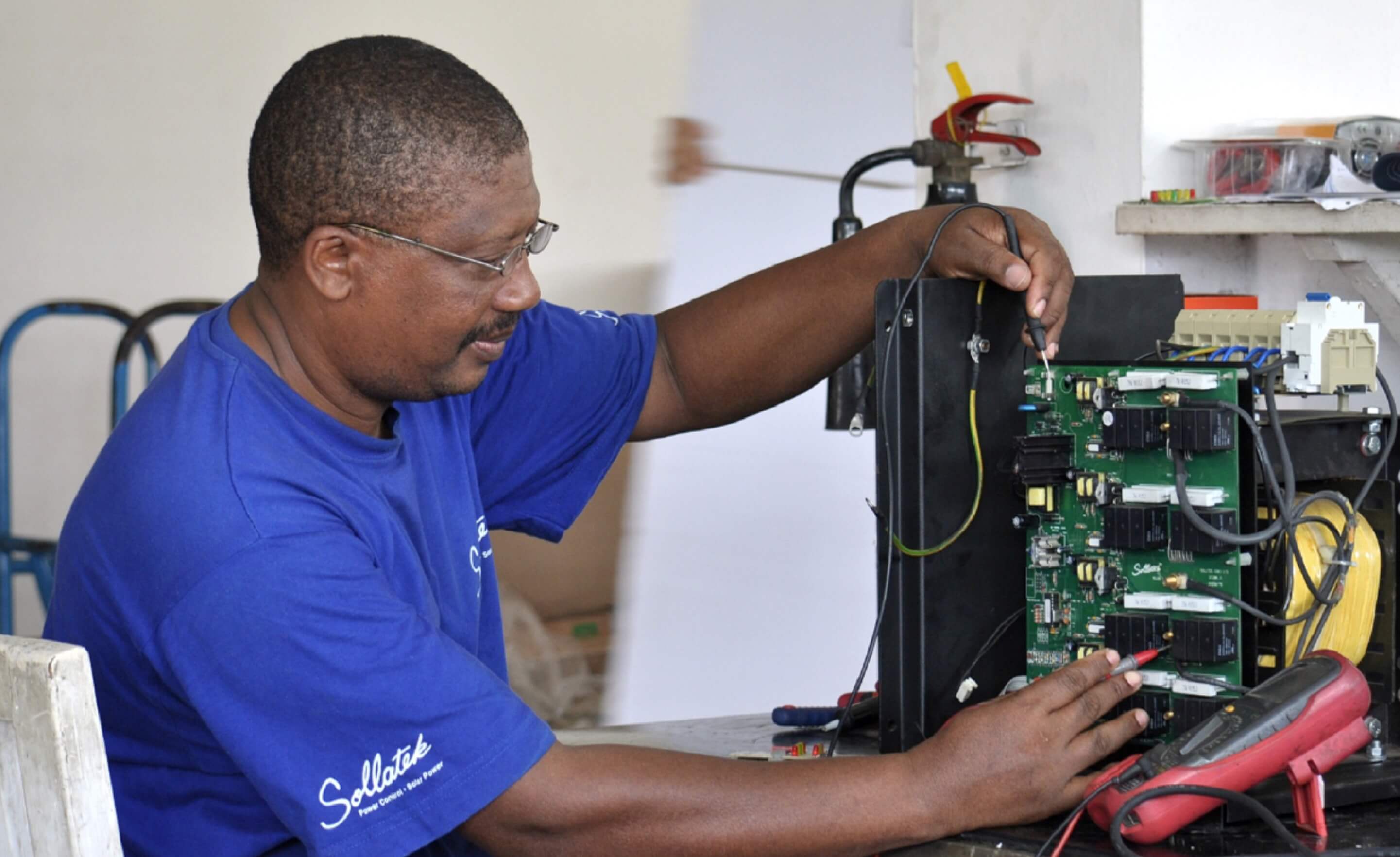

Sollatek is 100% Kenyan owned and managed, and has been operational in East Africa for over 30 years. During this time the market for solar products has changed significantly and with their experience and local knowledge Sollatek is well positioned to help the estimated 29 million individuals in Kenya who are currently 'off-grid' gain access to clean, reliable energy. Over the last 8 years Sollatek has sold over 835,000 solar lanterns and solar home systems (SHS).

About Sollatek

Key product information

Issuer: Sollatek Electronics (Kenya) Ltd

Issuing Country: Kenya

Investment target: £40,000

Minimum investment: £50

Maximum investment: No maximum

Maturity: 24 months

Expected interest rate: 6% per annum

Witholding tax rate: 15% (applicable to UK residents who do not invest within an IF ISA)

Interest payment frequency: Semi-annually

Notional repayment: Semi-annually (from 12 months onwards)*

Financial instrument: Unsecured interest bearing bond

Security: Unsecured

* For the first 12 months after the Issue Date, a "Grace Period" applies during which no capital repayments occur. The first capital payment will take place 12 months after the Issue Date, and on a semi-annual basis thereafter. Please refer to the amortization schedule found on Page 21 of the offer document.

Key risks

This is a bond issued by a single company (rather than a savings product) and therefore it is recommended that you are careful with the amount you invest.

You must read the investment memorandum (provided below) where a full statement of risks is presented.

Documents

What the project investment will enable

Further to our recent communication concerning the effect of COVID-19 on our Solar Partners, monies raised under this offer will be used to repay investors from an earlier campaign that is due on 01/06/20. This mechanism allows Sollatek to refinance their existing debt raised on Energise Africa on more favourable terms i.e. a 12 month grace period on capital repayments. Investors should be aware that this offer is for the specific purpose of easing short term cashflow of Sollatek, and that the increased uncertainty of investing into this campaign is mitigated to an extent through an increased interest rate of 6% relative to earlier Sollatek campaigns, which were offered at 5%.

You can read Energise Africa's full approach to COVID-19 here.

Sollatek Electronics Kenya

Sollatek is looking to raise £40,000 from this bond issue will be used to repay investors from an earlier campaign that is due on 01/06/20.

Sollatek prides itself on offering quality products at an affordable price and they offer free courier delivery on their products as well as a 2 year warranty (even without proof of purchase). From their 8 regional services centres across Kenya, Tanzania, Uganda and Burundi they can offer superior after sales care with most faults fixed within 72 hours.

Social and environmental impact

Solar home systems & lanterns have been shown to have a significant impact on customers' lives and the environment. To date, Sollatek has sold more than 835,000 systems & lanterns across East Africa, and has impacted the lives of around 4 million people.

Social Impact

The installation of solar home systems to off grid families has significant impacts that can be divided into the following categories: lifestyle, flexibility, health and safety, and economic. The following improvements below are associated with installation of Sollatek's solar home systems and access to reliable, renewable energy in general:

610%

Increase in available hours of light per household, associated with Sollatek's 30-40W systems

10-15%

of Sollatek's customers utilise their system to operate a business from their home

~50%

percentage of entrepreneurs participating in Sollatek's EEP project who are female, with top sales mostly attributable to them

16%

of individuals using a SHS for business purposes report that they are able to work for longer hours

Environmental impact

Using industry-recognised SolarAid impact metrics, Sollatek has calculated the environmental impact of the total number of systems installed since their incorporation as follows:

4 million

Number of people who have benefited from clean energy access

60%

respondents to a Power Africa survey reported reduced energy spend and kerosene use as the most appreciated benefit of SHS

1.1tonnes

Annual total CO2 emissions offset per household